When analyzing economic trends, business performance, or financial markets, you often hear terms like “leading indicators” and “lagging indicators.” Both play crucial roles but serve different purposes. Here’s a straightforward guide to help you grasp these concepts.

Leading Indicators

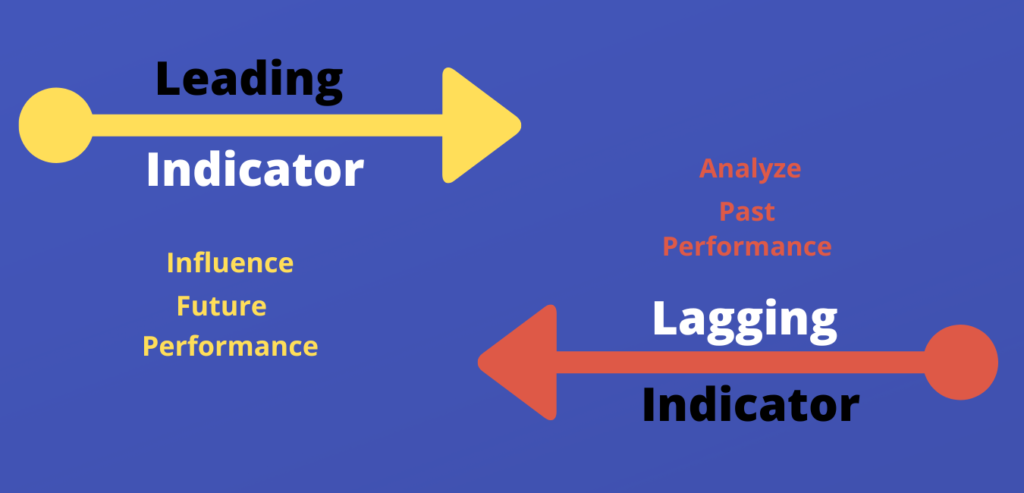

Leading indicators signal changes before they happen. They provide clues about future trends, helping you anticipate what might come next. These indicators are proactive, giving you a head start on adjusting strategies or making decisions.

Examples of Leading Indicators:

- Stock Market Performance: Often predicts future economic activity. A rising stock market might suggest economic growth ahead.

- Consumer Confidence Index: Measures how optimistic consumers feel about the economy. High confidence can signal increased spending and economic expansion.

- New Housing Starts: An increase in new home construction usually indicates future growth in the economy.

By focusing on these indicators, you can prepare for potential changes before they fully materialize.

Lagging Indicators

Lagging indicators, on the other hand, confirm trends after they have already begun. They are reactive, meaning they show what has happened rather than what might happen. These indicators help you understand the strength and sustainability of a trend.

Examples of Lagging Indicators:

- Unemployment Rate: This figure changes after the economy has already shifted, reflecting past economic conditions rather than predicting future ones.

- Gross Domestic Product (GDP): Measures the total economic output. It reports past performance and helps confirm trends.

- Corporate Profits: Reflects the profitability of businesses over time, showing how well companies have performed in the recent past.

Using lagging indicators helps you confirm whether a trend is solid and enduring. They offer insight into the effectiveness of past decisions and can validate the predictions made using leading indicators.

How They Work Together

In practice, leading and lagging indicators complement each other. Leading indicators help you anticipate and plan for future changes, while lagging indicators confirm whether your expectations are on track. Together, they provide a fuller picture of economic and business environments.

By understanding and utilizing both types of indicators, you can make more informed decisions, anticipate challenges, and capitalize on opportunities.